Avoiding Tax Penalties in the Philippines

You finally got a hold of your sweet, hard-earned money. As a reward, you treated yourself to a nice, quick travel vacation and saved the rest to your savings. Sounds ideal, but you forgot one tiny detail… you forgot your taxes.

That’s okay. There’s a next time. It’s just a small penalty fee. No need to worry, right? Wrong. That small penalty fee can snowball into something bigger and you may end up losing more money. Goodbye savings or investments.

Keep reading to find out what penalties to avoid and tips to manage a stress-free tax preparation.

Philippine Tax Penalties

Penalties differ depending on your annual income. Avoid these tax penalties by reading what they are below.

I. Surcharge of 25%

Civil penalties are an additional 25% of the amount due and imposed in the following cases:

a. Failure to file any return and pay the tax on-time;

b. Filing a return to a different internal revenue officer with whom the return is required to be filed;

c. Failure to pay the deficiency tax within the prescribed time; or

d. Failure to pay the tax on-time in any return required to be filed or no return required to be filed

II. Interest of 12%

With unpaid taxes, an interest of 12% per annum is charged in accordance with the Tax Reform for Acceleration and Inclusion (TRAIN) law.

There are two types: deficiency and delinquency.

A. Deficiency Interest

This applies to any deficiency found in assessment and imposed from the time of issuance until the tax is fully paid or by the demand of the Commissioner of Internal Revenue.

B. Delinquency Interest

This applies when there is failure to pay any tax and deficiency taxes on the deadline, as demanded by the Commissioner.

Don’t worry! These interest charges cannot be imposed simultaneously.

III. Compromise

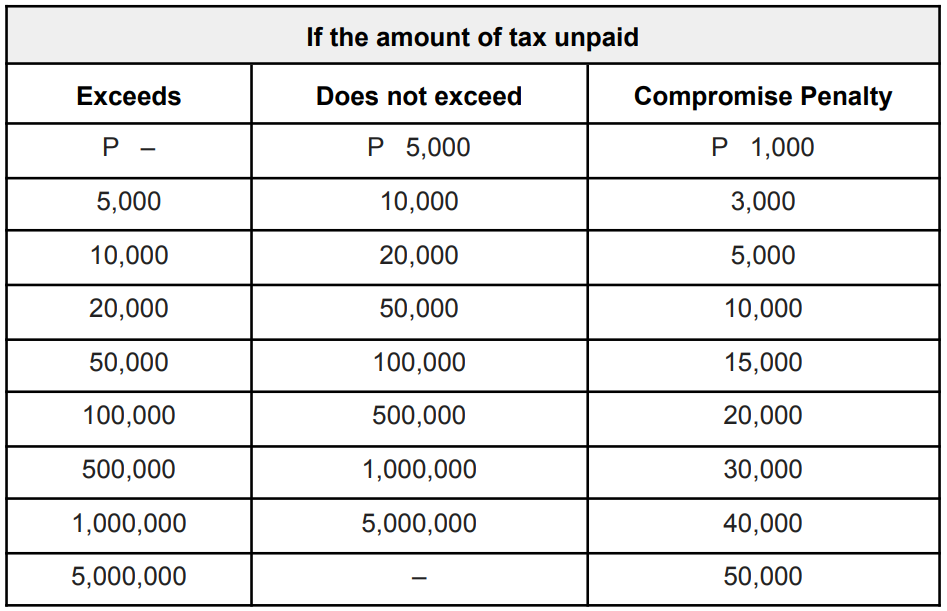

There are certain violations that could result in criminal penalties if you fail to comply with BIR’s tax compliance. If such an event comes to unfold, a compromise penalty may be given as a last resort.

The table below is an example of how much compromise penalty you might need to pay:

Ways to Ensure Tax Compliance

Tip #1: Mark your Calendars

The best way to start is knowing your tax deadlines. The Philippines follows a pay-as-you-file system, which allows you to decide how much and when you will pay your taxes. If you feel like a simple calendar reminder won’t do the trick, you can rely on Babylon2k’s Reminders. This subscription-based service will send you a reminder about tax deadlines through our Facebook page.

Keep in mind that the deadliest deadline to file for your annual tax returns is due on April 15 every year. If you’re filing for quarterly taxes, the deadlines are on the 15th of May, August and November.

Tip #2: Know your Tax

After your tax deadlines, the next tip is to know your tax obligations. It will be overwhelming to learn all at once, so you can try to learn it via T.A.X. (Tax, Accounting, and auXiliary Services) “Satori” & Tutorial.

It was developed to cater to the pressing issues in taxation, finance, and other related matters, especially those who were affected by COVID19. It covers different processes of government agencies namely: Bureau of Internal Revenue, Securities and Exchange Commission, Insurance Commission, Cooperative Development Authority, National Electrification Administration. Get unlimited access to blogs, tutorials, write-ups, and articles that allow you to learn and gain extensive knowledge about taxation, and hours worth of consultation with tax experts.

Know more about your tax obligations with SATORI and get the advice that you need here.

Tip #3: File your Taxes Online

To make BIR tax compliance easier, their website has an accessible online record system called Electronic Filing and Payment System (eFPS). It offers free tax preparation software that allows you to enter data, validate, save, and submit your tax returns. Easy!

Aside from the BIR, other government agencies could also impose penalties for non-compliance. We’ve got you covered as Babylon2K offers an automated GIS filing that will minimize manual errors and improve your SEC compliance.

Tip #4: Avoid waiting until Tax Season

Don’t put off what you can do now until it is too late. There are a lot of things that can happen: missing documents, crashed servers, no Wi-Fi– that will give you a lot of stress. Start practicing good preparation habits by organizing your receipts and transactions, keeping up to date with the news, and filing on time.

Proper compliance is key to avoiding problems with the BIR. Let’s be responsible Filipinos.

Learn more about easing TAX habits with Babylon2k.

No Comments yet!