Home buyers in the Philippines pay almost twice the global average tax on property purchases

- Spain, Belgium and Japan all tax more than 10% on house purchases

- Pressure to increase property taxes to address costs of coronavirus

- Homebuyers in the US pay virtually zero tax

Homebuyers in the Philippines now pay almost twice the global average tax on property purchases, at 8.13% compared to 4.51% worldwide, shows a new study by UHY, the international accountancy network.

UHY’s study shows that a homebuyer in the Philippines pays USD12,187 on a purchase of a home worth USD150,000, compared with a global average of USD6,771 (see table below).

For higher-value properties, tax in the Philippines’ system is the same, at 8.13% on the purchase of a property worth USD1 million or USD2 million.

The Philippines charges significantly higher taxes on a USD150,000 property purchase than similar economies such as Vietnam (2.5%). The average tax charged worldwide on the purchase of a home worth USD150,000 has now reached 4.51% – a cost of USD6,771 even for a relatively modest home.

UHY M.L. Aguirre & Co. CPAs, UHY’s member firm in the Philippines, explains that over the last few years the impact of this property tax has been partly hidden by the increase in property prices in the Philippines. However, if the market slows down as a result of Coronavirus, this tax burden will become much more obvious to purchasers.

UHY M.L. Aguirre & Co. CPAs also points out that the country’s property tax system, unlike in many other countries, is not structured with lower tax rates on lower-value property. This contrasts sharply with systems used in some other parts of the world, where high property taxes on the most expensive homes subsidise low or zero rates on lower value property for lower income citizens.

UHY says that the cost to Governments worldwide of the coronavirus pandemic could result in pressure to increase property taxes in the coming years. A combination of lower tax revenues and expensive economic stimulus measures will leave many countries with major budget deficits that will need to be addressed.

It adds that while increasing property taxes may be an attractive source of revenue for governments, high taxes on property purchases can reduce labour market mobility as there will be a tax charge each time a property owner moves for work and buys a new home.

High property taxes can also distort the market by discouraging older homeowners from downsizing as this would result in a tax charge on the purchase of their new smaller home. Some commentators have also argued that high property taxes disincentivise homeowners from selling a property with the intention of buying back into the market if prices slip. This removes a key mechanism for dampening house prices.

The average tax paid on a home purchase has risen quickly in recent years. A previous study of property taxes by UHY, in 2013, found that G7 countries charged an average of 2.29% tax on the purchase of a home worth USD150,000. This has now risen to an average of 3.57% in 2020.

Eliseo Aurellado, Audit Director at UHY M.L. Aguirre & Co. CPAs says: “The Philippine property tax system has no subsidy for buyers of lower-value homes. Property taxes weigh quite heavily on a lot of ordinary people.”

“For wealthier property investors, the rise in property prices in recent years has made it easier to deal with the cost of taxes, but that will change quickly if the market levels off.”

“Taxing property purchases is one way to increase tax receipts to address the costs of coronavirus. However, taxes on property transactions penalise ordinary people who sell their homes and increase liquidity in the housing market. It’s not hard to see how that can distort the market and drive prices up artificially.”

“If governments are in favour of home ownership, why put such huge levels of tax on it?”

“It has been argued that raising property taxes helps to deflate property bubbles, but their track record in doing that is patchy at best. They also make it more difficult for people to move to areas where their skills are more in demand, impacting economic productivity.”

UHY’s study also shows that several major developed economies now charge tax worth more than 10% on the purchase of a home worth USD150,000, including Belgium (11.66%) and Japan (11%).

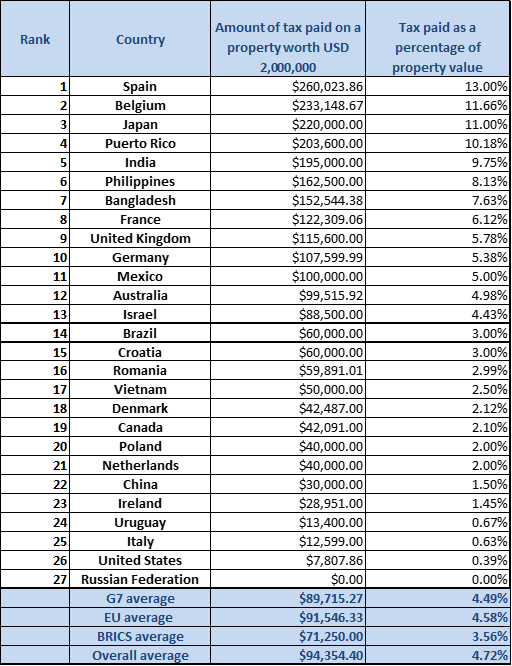

Rates of tax on a purchase of a home worth USD2 million across the United States average just 0.39%, while Russia levy no tax at all on purchases of residential property, regardless of value.

UHY tax professionals studied tax data for individuals purchasing a house worth USD150,000, USD1 million and USD2 million in 27 countries across its international network, including all members of the G7, as well as key emerging economies.

All 27 countries ranked by the amount and the percentage of tax paid on a purchase of a USD150,000 property – Spain, Bangladesh, Belgium and Japan all above 10%

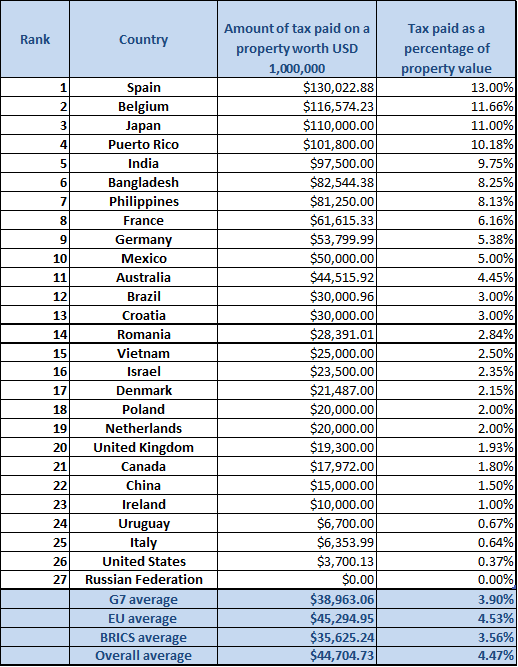

All 27 countries ranked by the amount and the percentage of tax paid on a purchase of a USD1 million property – UK Stamp Duty regime much tougher on USD1 million purchases

All 27 countries ranked by the amount and the percentage of tax paid on a purchase of a USD2 million property – USD2 million homebuyers in the US pay virtually zero tax

Blog Category

Related Post

- Navigating New Horizons – Doing Business in The Philippines Guide 2025

- i-Lead Academy Manual for Members/Students

- Foreign Currency Transactions Treatment for Financial Reporting and Tax Reporting Purposes

- 2023 YEAR END and 2024 1st QUARTER Reportorial Requirements

- Charting the New Frontier: How the 43rd ASEAN Summit Paves the Way for an Unprecedented Era of Trade and Innovation in Southeast Asia.