“Ask For Receipt” of existing taxpayers shall only be valid until June 30, 2023, due to Notice to Issue Invoice/Receipt (NIRI) per RMO 43-2022

The new BIR Notice to Issue Invoice/Receipt (NIRI) was introduced under Revenue Regulation (RR) No. 10-2019 which requires taxpayers to issue receipts/invoices for the sale of goods or services rendered.

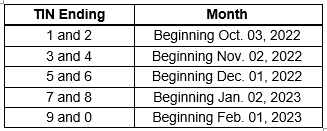

Now with the newly issued policies, procedures, and guidelines of BIR Revenue Memorandum Order (RMO) 43-2022, “Ask For Receipt” shall only be valid until June 30, 2023, and it shall be replaced by NIRI to existing registered business. The issuances of NIRI will be staggered and based on the ending digit of the Taxpayer Identification Number (TIN), to wit:

However, RMO 43-2022 stated that before a registered business taxpayer requests to replace their “Ask For Receipt” they shall first update their registration information, specifically the registered business taxpayer is required to designate an official company email address before they release the NIRI.

The purpose of the official email address is for BIR to use it when serving its orders, notices, letters, communications, and other processes to taxpayers.

Other than the existing registered business, RMO 43-2022 also covered New Business Registrants (NBR) head office and branches and online sellers and merchants, vloggers, social media influencers, and online content creators earning income from the platform and/or advertising.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

Contact our office for any inquiry. (ask@mlaguirre.org)

You may avail subscription on SATORI to know more and get the advice that you need. (iLEAD Academy – T.A.X Satori Tutorial (i-leadacademy.org)

No Comments yet!