Application for SEC’s Grant of Amnesty on or before April 30, 2023

Grant of Amnesty for Non-Filing and Late filing of the General Information Sheet (GIS) and Annual Financial Statement (AFS), and Non-Compliance with Memorandum Circular No. 28, S. 2020

SEC Memorandum Circular NO. 2, Series of 2023 was released by the Securities and Exchange Commission (SEC) on March 16, 2023. It provides a set of rules and procedures to follow for those who wish to apply for amnesty on the fines and penalties imposed by the SEC due to three reasons: (i) failure to submit or submitting the General Information Sheet (GIS) beyond the deadline for the current and previous years, (ii) failure to submit or submitting the Annual Financial Statements (AFS) beyond the deadline for the current and previous years, and (iii) not adhering to MC No. 28, s.2020.

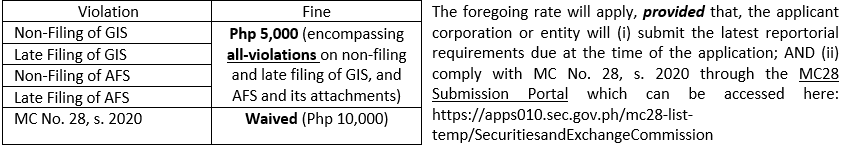

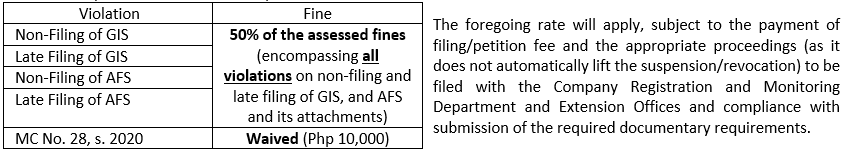

As provided under Section 2 of the subject Memorandum, the applicable rates are as follows:

A. Non-Filing and Late Filing of GIS and/or AFS, and MC No. 28 violation:

B. Suspended and Revoked Corporations:

How to Apply: As provided under Section 3 of the subject Memorandum, on or before April 30, 2023, the duly authorized representative/resident agent of the corporation (“Applicant”) shall file an Online Expression of Interest Form (“EOI”) (see Annex A) through the SEC’s Electronic Filing and Submission Tool (eFAST), the applicant must also present proof of its authority together with the following documents:

- For Domestic Corporations (Ordinary and Non-Stock):

- Latest due FS or undertaking to submit FS within forty-five (45) calendar days from the issuance of confirmation of payment;

- Latest due Amended FS, if any;

- Latest due GIS;

- Latest due Amended GIS, if any; and

- Proof of compliance with MC No. 28.

- For Foreign Corporations (Branch Offices, Representative Offices, Regional Area Headquarters, and Regional Operating Headquarters):

- Latest due FS or undertaking to submit FS within forty-five (45) calendar days from the issuance of confirmation of payment;

- Latest due Amended FS, if any;

- Latest due GIS;

- Latest due Amended GIS, if any; and

- Proof of compliance with MC No. 28.

To comply with the requirements outlined in Sections 3.1 and 3.2 of the relevant Memorandum, non-compliant corporations (those that have failed to submit their General Information Sheet (GIS) and Annual Financial Statements (AFS) on an intermittent or consecutive basis in previous years, or have failed to comply with MC No. 28, or both) must first file an online Expression of Interest (EOI) Form via the Securities and Exchange Commission’s (SEC) eFAST system. Upon submission of the EOI Form, the eFAST system will generate a Payment Assessment Form (PAF) with a fixed amnesty amount of P5,000.

After the Payment Assessment Form has been generated, the Applicant is required to settle the balance using the Securities and Exchange Commission’s Electronic System for Payment (eSPAYSEC). Once payment has been made, an electronic Official Receipt (eOR) will be generated. The Applicant must then upload the Notarized Application for Amnesty Form (refer to Annex B-1) and the required supporting documents listed above. Upon submission, the documents will be evaluated for compliance. If found to be compliant, a Confirmation of Payment of Amnesty Fees will be issued to the corporation’s registered email address.

For those under the status of Revoked and Suspended corporations, they are not precluded from filing amnesty under the subject Memorandum, their application would be through online EOI Form together with a Petition to Lift Order of Suspension/Revocation, and proof of their compliance under MC No. 28, s. 2020 through eFAST also.

Take note that MC No. 28 is part of the compliance, as enrollment through MC28 Submission Portal is a prerequisite in order to process the application. After settling fees, the Applicant shall upload the Notarized Application for Amnesty Form (see Annex B-2) along with the documentary requirements above stated.

After the completion of the process and monitoring, the Applicant will receive an email notification from the appropriate Operating Department, Executive Office (EO), or the Commission Monitoring Department (CMD). This email will contain the Payment Assessment Form (PAF), which will reflect 50% of the total assessed fines. The Applicant is required to settle this fee using the SEC’s eSPAYSEC or Land Bank of the Philippines’ On-Coll Facility. Upon payment, the Applicant must secure a copy of the electronic Official Receipt (eOR) from the website espaysec.sec.gov.ph/eor.

Upon completion of payment and successful monitoring, the Applicant will receive a Confirmation of Payment for Amnesty on Fines and Penalties through their registered email address. The email will also contain the updated status of the corporation.

Most importantly, as provided under Section 5 of the subject Memorandum, the following entities are excluded from the coverage of the amnesty:

- Corporations whose securities are listed on the Philippine Stock Exchange (“PSE”);

- Corporations whose securities are registered but not listed on the PSE;

- Corporations considered as Public Companies;

- Corporations with intra-corporate dispute;

- Corporations with disputed GIS; and

- Other corporations covered under Sec. 17.2 of RA No. 8799 or the “Securities Regulation Code.”

Only those who properly observed these procedures can avail of the said amnesty which shall be filed on or before April 30, 2023, after which, the existing scale of fines would revert to normal.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

No Comments yet!