Significant Amendment to Glean from Revenue Memorandum Circular (RMC) No. 3-2023

Policies and Guidelines on the Online Registration of Books of Accounts (BAs)

On digitalizing its operations, the Bureau of Internal Revenue (BIR) alerted the taxpayers regarding RMC No.3-2023, amending Section 2 of RMC No.29-2019, which prescribes the policies and guidelines on the online registration of Book of Accounts (BAs).

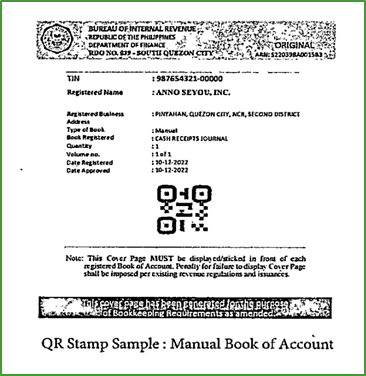

All BAs shall be registered online with the Bureau’s Online Registration and Update System (ORUS). In place of manual stamping, the system shall generate the Quick Response (QR) code when registered successfully at http://orus.bir.gov.ph. Scanning the code using any smartphone will redirect to the ORUS website, validating the code’s authenticity. The taxpayers shall paste the generated QR stamp on the first page of their manual book of accounts and permanently bind the loose-leaf book of accounts. For computerized books of accounts, the QR Stamp shall be attached to the transmittal letter showing detailed content of the USB flash drive where the books of accounts and other accounting records are stored or saved.

The QR stamp (Figure 1) shall print the following taxpayer’s information:

- TIN;

- Registered Name;

- Registered Address;

- Type of Book (Manual, Loose-leaf, or Computerized);

- Book Registered;

- Permit No./Acknowledgment Certificate Control No. (ACCN) for Loose leaf or Computerized;

- PTU/ACCN Date issued – for Loose Leaf or Computerized;

- Quantity;

- Volume No;

- Date Registered; and

- Date Approved

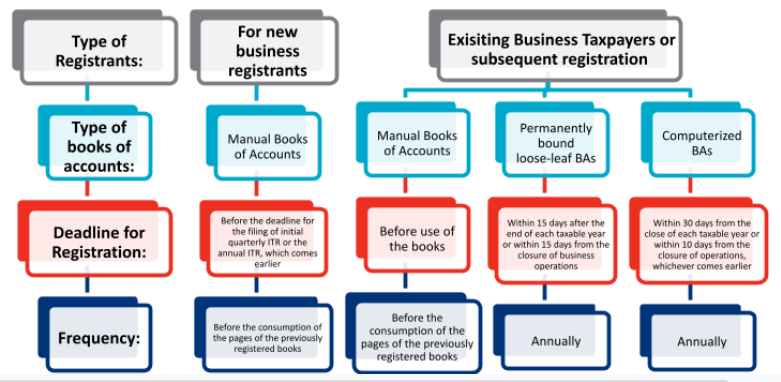

Taxpayers are not required to register a new set of manual BAs every year; however, taxpayers may opt to use a new set of books of accounts yearly which they should register before its use. Below is the summary of the manners of bookkeeping or maintaining books of accounts under RMC No. 3-2023:

The taxpayers shall still be allowed to register and stamp their manual books of accounts at the Revenue District Office (RDO) or Large Taxpayer Division/Office where the Head Office or Branch is registered while the implementation of the circular is still in transition. Meanwhile, the RDO or Large Taxpayer Division/Office shall inform taxpayers under its jurisdiction that the registration of books of accounts can be done manually or online via announcements.

For your guidance and perusal.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

No Comments yet!