New and Revised PFRSs for Annual Periods beginning on or after January 01,2023

Amendments to Philippine Accounting Standards (PAS)

I. Effective beginning on or after January 1, 2023

The following amendments to Philippine Accounting Standards (PAS) are effective for annual periods beginning on or after January 1, 2023:

- Amendments to PAS 1, Presentation of Financial Statements and PFRS Practice Statement 2 Making Materiality Judgements—Disclosure of Accounting Policies

- Amendments to PAS 8 Accounting Policies, Changes in Accounting Estimates and Errors —Definition of Accounting Estimates

- Amendments to PAS 12 Income Taxes—Deferred Tax related to Assets and Liabilities arising from a Single Transaction

Companies reporting under Philippine Financial Reporting Standards (PFRSs) must disclose the said pronouncements in their financial statements, including the impact of future adoption, if any. If there is no expected impact on the Company’s financial reporting, the same must also be disclosed

The following are the key points of the accounting standards pronouncements:

1. Amendments to PAS 1 Presentation of Financial Statements and PFRS Practice Statement 2 Making Materiality Judgements—Disclosure of Accounting Policies

The amendments change the requirements in PAS 1 with regard to the disclosure of accounting policies. The amendments replace all instances of the term ‘significant accounting policies’ with ‘material accounting policy information’. Accounting policy information is material if, when considered together with other information included in an entity’s financial statements, it can reasonably be expected to influence decisions that the primary users of general-purpose financial statements make on the basis of those financial statements.

The supporting paragraphs in PAS 1 are also amended to clarify that accounting policy information that relates that immaterial transactions, other events or conditions is immaterial and need not be disclosed. Accounting policy information may be material because of the nature of the related transactions, other events or conditions, even if the amounts are immaterial. However, not all accounting policy information relating to material transactions, other events or conditions is itself material.

Early application is permitted in applying amendments to PAS 1. The amendments are applied prospectively. The amendments to PFRS Practice Statement 2 do not contain an effective date or transition requirements.

2. Amendments to PAS 8 Accounting Policies, Changes in Accounting Estimates and Errors —Definition of Accounting Estimates

The amendments replace the definition of a change in accounting estimates with a definition of accounting estimates. Under the new definition, accounting estimates are “monetary amounts in financial statements that are subject to measurement uncertainty”.

The definition of a change in accounting estimates was deleted. However, the Board retained the concept of changes in accounting estimates in the Standard with the following clarifications:

a. A change in accounting estimate that results from new information or new developments is not the correction of an error; and

b. The effects of a change in an input or a measurement technique used to develop an accounting estimate are changes in accounting estimates if they do not result from the correction of prior period errors.

Earlier application is permitted.

3. Amendments to PAS 12 Income Taxes—Deferred Tax related to Assets and Liabilities arising from a Single Transaction

The amendments introduce a further exception from the initial recognition exemption. Under the amendments, an entity does not apply the initial recognition exemption for transactions that give rise to equal taxable and deductible temporary differences.

Depending on the applicable tax law, equal taxable and deductible temporary differences may arise on initial recognition of an asset and liability in a transaction that is not a business combination and affects neither accounting nor taxable profit. For example, this may arise upon recognition of a lease liability and the corresponding right-of-use asset applying PFRS 16 at the commencement date of a lease.

Following the amendments to PAS 12, an entity is required to recognize the related deferred tax asset and liability, with the recognition of any deferred tax asset being subject to the recoverability criteria in PAS 12.

The amendments apply to transactions that occur on or after the beginning of the earliest comparative period presented. In addition, at the beginning of the earliest comparative period an entity recognizes:

- A deferred tax asset (to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised) and a deferred tax liability for all deductible and taxable temporary differences associated with:

- Right-of-use assets and lease liabilities

- Decommissioning, restoration and similar liabilities and the corresponding amounts recognized as part of the cost of the related asset

- The cumulative effect of initially applying the amendments as an adjustment to the opening balance of retained earnings (or other component of equity, as appropriate) at that date

Earlier application is permitted.

The Companies are expected to comply with the above PFRS/PAS pronouncements, otherwise, they will be subjected to fines and penalties by the SEC during the monitoring

II. New and Revised PFRSs in Issue but Not Yet Effective

A. Effective beginning on or after January 1, 2024

1. Amendments to PAS 1, Classification of Liabilities as Current or Non-current

The amendments clarify paragraphs 69 to 76 of PAS 1, Presentation of Financial Statements, to specify the requirements for classifying liabilities as current or non-current. The amendments clarify:

- What is meant by a right to defer settlement.

- That a right to defer must exist at the end of the reporting period

- That classification is unaffected by the likelihood that an entity will exercise its deferral right

- That only if an embedded derivative in a convertible liability is itself an equity instrument would the terms of a liability not impact its classification

The amendments are effective for annual reporting periods beginning on or after January 1, 2023 and must be applied retrospectively. However, in November 2021, the International Accounting Standards Board (IASB) tentatively decided to defer the effective date to no earlier than January 1, 2024.

B. Effective beginning on or after January 1, 2025

1. PFRS 17, Insurance Contracts

PFRS 17 is a comprehensive new accounting standard for insurance contracts covering recognition and measurement, presentation and disclosure. Once effective, PFRS 17 will replace PFRS 4, Insurance Contracts. This new standard on insurance contracts applies to all types of insurance contracts (i.e., life, non-life, direct insurance and re-insurance), regardless of the type of entities that issue them, as well as to certain guarantees and financial instruments with discretionary participation features. A few scope exceptions will apply.

The overall objective of PFRS 17 is to provide an accounting model for insurance contracts that is more useful and consistent for insurers. In contrast to the requirements in PFRS 4, which are largely based on grandfathering previous local accounting policies, PFRS 17 provides a comprehensive model for insurance contracts, covering all relevant accounting aspects. The core of PFRS 17 is the general model, supplemented by:

- A specific adaptation for contracts with direct participation features (the variable fee approach)

- A simplified approach (the premium allocation approach) mainly for short-duration contracts

On December 15, 2021, the FRSC amended the mandatory effective date of PFRS 17 from January 1, 2023 to January 1, 2025. This is consistent with Circular Letter No. 2020-62 issued by the Insurance Commission which deferred the implementation of PFRS 17 by two (2) years after its effective date as decided by the IASB.

PFRS 17 is effective for reporting periods beginning on or after January 1, 2025, with comparative figures required. Early application is permitted.

2. Amendments to PFRS 17, Initial Application of PFRS 17 and PFRS 9— Comparative Information

The amendment adds a transition option for a classification overlay to address possible accounting mismatches between financial assets and insurance contract liabilities in the comparative information presented on initial application of PFRS 17. The amendments would be available for:

- any financial assets, including those held in respect of an activity that is unconnected to contracts within the scope of PFRS 17; and

- both entities that initially apply PFRS 9 at the same time as they apply PFRS 17, and entities that had already applied IFRS 9 before the initial application of PFRS 17 where those entities redesignate financial assets applying paragraph C29 of PFRS 17.

The transition option would:

- be available, on an instrument-by-instrument basis;

- allow an entity to present comparative information as if the classification and measurement requirements of PFRS 9 had been applied to that financial asset, but not require an entity to apply the impairment requirements of PFRS 9; and

- require an entity that applies the classification overlay to a financial asset to use reasonable and supportable information available at the transition date to determine how the entity expects that financial asset to be classified applying PFRS 9.

The amendment does not amend the transition requirements in PFRS 9. At the date of initial application of IFRS 9, an entity is required to apply the transition requirements in IFRS 9 to a financial asset, regardless of whether it has applied the classification overlay to that asset.

The amendment 17 is effective for reporting periods beginning on or after January 1, 2025. Early application is permitted.

C. Deferred Effectivity

1. Amendments to PFRS 10, Consolidated Financial Statements, and PAS 28, Sale or Contribution of Assets between an Investor and its Associate or Joint Venture

The amendments address the conflict between PFRS 10 and PAS 28 in dealing with the loss of control of a subsidiary that is sold or contributed to an associate or joint venture. The amendments clarify that a full gain or loss is recognized when a transfer to an associate or joint venture involves a business as defined in PFRS 3. Any gain or loss resulting from the sale or contribution of assets that does not constitute a business, however, is recognized only to the extent of unrelated investors’ interests in the associate or joint venture.

On January 13, 2016, the Financial Reporting Standards Council deferred the original effective date of January 1, 2016 of the said amendments until the International Accounting Standards Board (IASB) completes its broader review of the research project on equity accounting that may result in the simplification of accounting for such transactions and of other aspects of accounting for associates and joint ventures.

2. Deferral of Certain Provisions of PIC Q&A 2018-12, PFRS 15 Implementation Issues Affecting the Real Estate Industry (as amended by PIC Q&As 2020-02 and 2020-04)

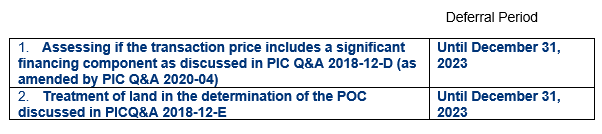

On February 14, 2018, the PIC issued PIC Q&A 2018-12 which guides on some PFRS 15 implementation issues affecting the real estate industry. On October 25, 2018, and February 08, 2019, the Philippine Securities and Exchange Commission (SEC) issued SEC MC No. 14- 2018 and SEC MC No. 3-2019, respectively, providing relief to the real estate industry by deferring the application of certain provisions of this PIC Q&A for three years until December 31, 2020. On December 15, 2020, the Philippine SEC issued SEC MC No. 34-2020 which further extended the deferral of certain provisions of this PIC Q&A until December 31, 2023. A summary of the PIC Q&A provisions covered by the SEC deferral and the related deferral period follows:

The SEC Memorandum Circulars also provided the mandatory disclosure requirements should an entity decide to avail of any relief. Disclosures should include:

- the accounting policies applied;

- discussion of the deferral of the subject implementation issues in the PIC Q&A;

- qualitative discussion of the impact on the financial statements had the concerned application guidelines in the PIC Q&A been adopted; and

- should any of the deferral options result in a change in accounting policy (e.g., when an entity excludes land and/or uninstalled materials in the POC calculation under the previous standard but opted to include such components under the relief provided by the circular) such accounting change will have to be accounted for under PAS 8, i.e., retrospectively, together with the corresponding required quantitative disclosures.

In November 2020, the PIC issued the following Q&As which provide additional guidance on the real estate industry issues covered by the above SEC deferrals:

- PIC Q&A 2020-04, which provides additional guidance on determining whether the transaction price includes a significant financing component.

- PIC Q&A 2020-02, which provides additional guidance on determining which uninstalled materials should not be included in calculating the POC

After the deferral period, real estate companies have an accounting policy option of applying either the full retrospective approach or a modified retrospective approach as provided under SEC MC 8-2021.

For your guidance and perusal.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

No Comments yet!