The Crux of R.A. 11934 or the SIM Registration Act

General Rules and Guidelines for Registration of SIMs

The Republic Act 11934 or also known as the “Subscriber Identity Module (SIM) Card Registration Act,” was signed into law on October 10, 2022, requiring end-users to register their new or existing SIM cards with their respective Public Telecommunications Entities (PTEs) within 180 days from the law’s effectivity date.

A SIM card carries a unique international mobile subscriber number to identify and authenticate subscribers on mobile electronic devices. Its mandatory registration will serve as a preventive measure addressing the rising mobile phone-aided crimes such as text scams. The rollout will be on December 27, 2022, 15 days after the issuance of the National Telecommunications Commission’s (NTC) implementing rules and regulations (IRR) of RA 11934.

A SIM will be deactivated if the end-users fail to comply with the said registration process. However, it may be reactivated after the end-users register the SIM within five days from the automatic deactivation.

Registration guidelines

The PTEs will provide their users with virtual platforms to accomplish the registration process and should ensure that the end-users’ data are secured and protected at all times by complying with the minimum information security standards prescribed by the Department of Information and Communications Technology (DITC).

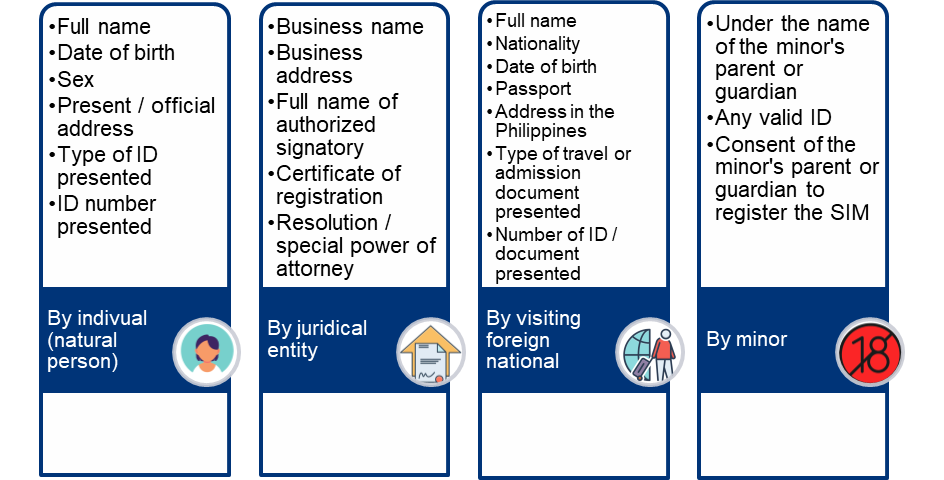

The following are the data and information needed and the documents to be presented in the registration process by end-users:

Penalties

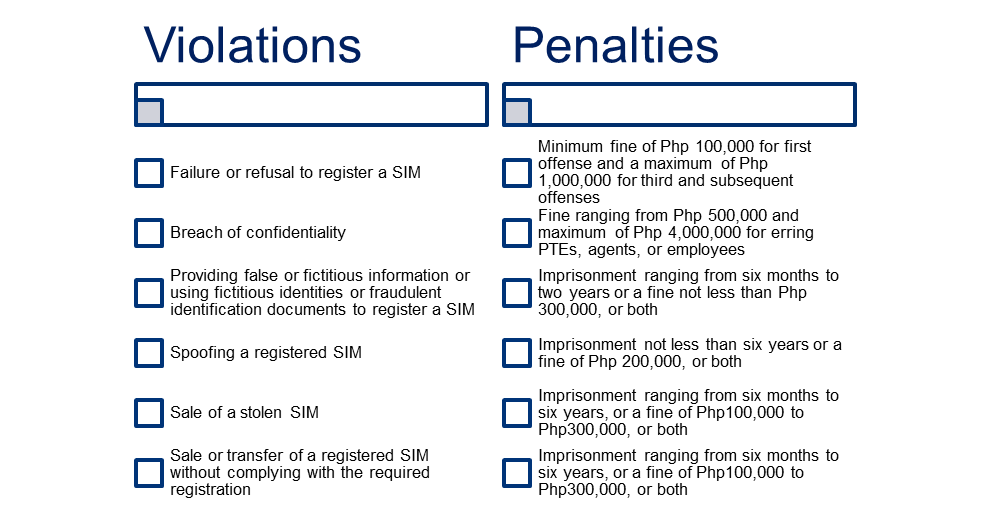

Here is the summary of the penalties with the corresponding violations reiterated by the Act and the published IRR:

This advisory is for your guidance and perusal.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

No Comments yet!