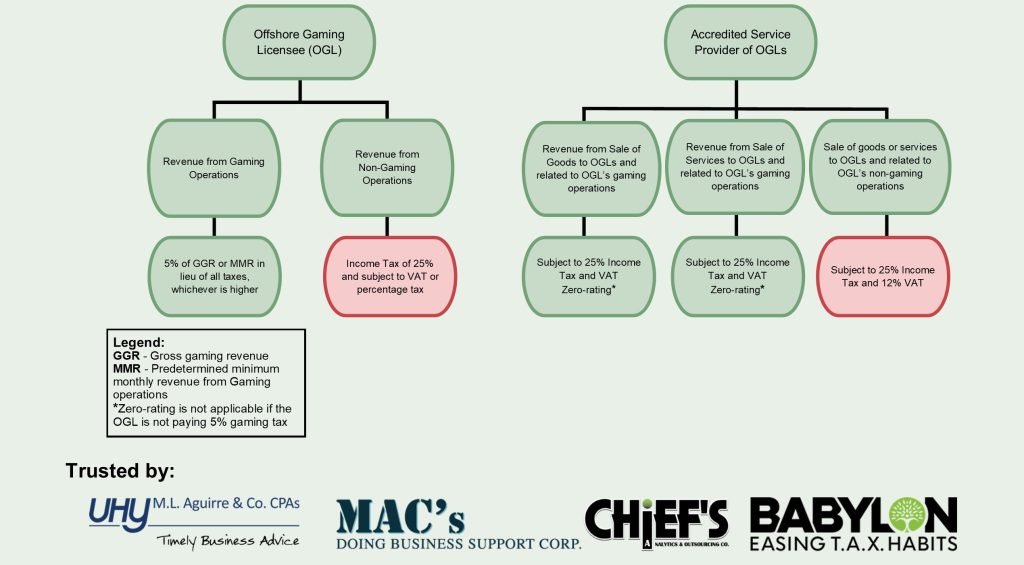

Taxation of PH Based Offshore Gaming Licensee and their Accredited Service Providers (RR No. 20-2021)

Q1: What are OGL and Accredited Service Providers? Are they considered POGO?

Answer: Both are considered as POGO, however, OGL refers to an Offshore Gaming Operator, regardless of where it is organized, duly licensed, and authorized through a gaming license issued by a POGO Licensing Authority to conduct offshore gaming operations, including the acceptance of bets from offshore customers. On the other hand, Accredited Service Providers refer to any natural person, or juridical person, which provides ancillary services to an OGL or any other offshore gaming operator with a license acquired from other jurisdictions.

Q2: What is the difference in Income between Gaming and Non-gaming operations?

Answer: Income from Gaming Operations refers to income or earnings realized or derived from operating online games of chance or sporting event via the internet using a network and software or program while Non-gaming Operations refer to any other income or earnings realized or derived: within the Philippines (for Foreign-based OGLs), and within and without the Philippines (for Philippine-based OGLs), that are not classified as income from gaming operations.

Q3: Are OGL and Accredited service providers required to withhold and remit withholding taxes?

Answer: OGL and Accredited Service providers are still required to withhold and remit withholding taxes (RMC No. 102-17)

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

👏