Impact of SEC Memorandum Circular No. 1 – Series of 2022, on the Companies’ Financial Reporting and Practitioners’ Engagement Performance

SEC requires the preparers of financial statements and audit practitioners to consider and comply with the newly adopted Philippine Financial Reporting Standards (PFRS) and Philippine Standards on Auditing (PSA)

On January 27, 2022, the Securities and Exchange Commission (SEC) mandated the consideration of certain Philippine Standards on Auditing (PSA) and Philippine Financial Reporting Standards (PFRS) standards in companies’ financial reporting. These pronouncements have been adopted by the Auditing and Assurance Standards Council and the Financial Reporting Standards Council and subsequently approved by the Board of Accountancy and Professional Regulation Commission.

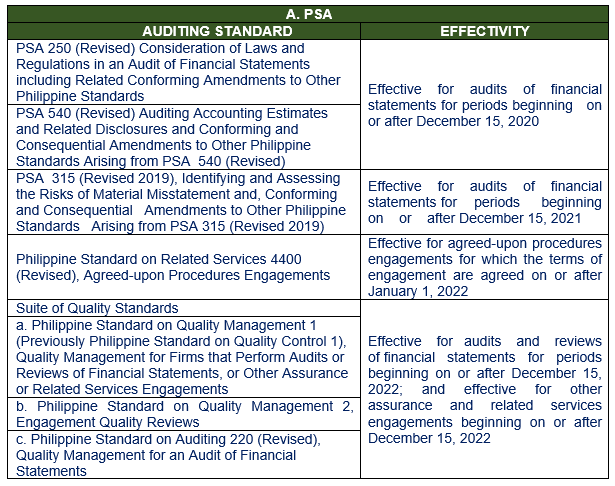

Hereunder are the list of auditing standards including their effectivity dates:

The above-mentioned standards are expected to be considered by the practitioners in their statutory or special engagements being performed.

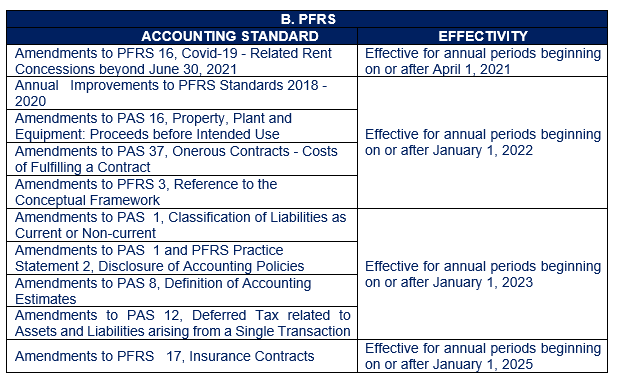

Meanwhile, below shows the list of accounting standards, including their effectivity dates:

Companies must disclose the said pronouncements in their financial statements, including the impact of future adoption, if any. If there is no expected impact on the Company’s financial reporting, the same must also be disclosed.

The following are the key points of the accounting standards pronouncements:

- Amendments to PFRS 16, Covid-19-Related Rent Concessions beyond June 30, 2021

In the prior year, Covid-19-Related Rent Concessions (Amendment to PFRS 16) provided practical relief to lessees in accounting for rent concessions occurring as a direct consequence of COVID-19, by introducing a practical expedient to PFRS 16. This practical expedient was available to rent concessions for which any reduction in lease payments affected payments originally due on or before June 30, 2021.

Covid-19-Related Rent Concessions beyond June 30, 2021 (Amendment to PFRS 16) extends the practical expedient to apply to reduction in lease payments originally due on or before June 30, 2022.

The practical expedient permits a lessee to elect not to assess whether a COVID-19-related rent concession is a lease modification. A lessee that makes this election shall account for any change in lease payments resulting from the COVID-19-related rent concession by applying PFRS 16 as if the change were not a lease modification.

The practical expedient applies only to rent concessions occurring as a direct consequence of COVID-19 and only if all of the following conditions are met:

- The change in lease payments results in revised consideration for the lease that is substantially the same as, or less than, the consideration for the lease immediately preceding the change.

- Any reduction in lease payments affects only payments originally due on or before June 30, 2022 (a rent concession meets this condition if it results in reduced lease payments on or before June 30, 2022 and increased lease payments that extend beyond June 30, 2022).

- There is no substantive change to the other terms and conditions of the lease.

- Annual Improvements to PFRS Standards 2018-2020

- Amendments to PFRS 1, First-time Adoption of Philippines Financial Reporting Standards, Subsidiary as a first-time adopter

The amendment permits a subsidiary that elects to apply paragraph D16(a) of PFRS 1 to measure cumulative translation differences using the amounts reported by the parent, based on the parent’s date of transition to PFRS. This amendment is also applied to an associate or joint venture that elects to apply paragraph D16(a) of PFRS 1.

- Amendments to PFRS 9, Financial Instruments, Fees in the ’10 per cent’ test for derecognition of financial liabilities

The amendment clarifies the fees that an entity includes when assessing whether the terms of a new or modified financial liability are substantially different from the terms of the original financial liability. These fees include only those paid or received between the borrower and the lender, including fees paid or received by either the borrower or lender on the other’s behalf. An entity applies the amendment to financial liabilities that are modified or exchanged on or after the beginning of the annual reporting period in which the entity first applies the amendment.

The amendments is applied to financial liabilities that are modified or exchanged on or after the beginning of the annual reporting period in which the entity first applies the amendment.

- Amendments to PAS 41, Agriculture, Taxation in fair value measurements

The amendment removes the requirement in PAS 41 for entities to exclude cash flows for taxation when measuring fair value. This aligns the fair value measurement in PAS 41 with the requirements of PFRS 13 Fair Value Measurement to use internally consistent cash flows and discount rates and enables preparers to determine whether to use pretax or post-tax cash flows and discount rates for the most appropriate fair value measurement.

The amendment is applied prospectively, i.e. for fair value measurements on or after the date an entity initially applies the amendment.

- Amendments to PFRS 16, Lease Incentives

The amendment to Illustrative Example 13 accompanying PFRS 16 removes from the example the illustration of the reimbursement of leasehold improvements by the lessor in order to resolve any potential confusion regarding the treatment of lease incentives that might arise because of how lease incentives are illustrated in that example.

- Amendments to PAS 16, Plant and Equipment: Proceeds before Intended Use

The amendments prohibit entities from deducting from the cost of an item of property, plant, and equipment, any proceeds from selling items produced while bringing that asset to the location and condition necessary for it to be capable of operating in the manner intended by management. Instead, an entity recognizes the proceeds from selling such items, and the costs of producing those items, in profit or loss.

The amendment must be applied retrospectively to items of property, plant, and equipment made available for use on or after the beginning of the earliest period presented when the entity first applies the amendment.

- Amendments to PAS 37, Onerous Contracts – Costs of Fulfilling a Contract

The amendments specify which costs an entity needs to include when assessing whether a contract is onerous or loss-making. The amendments apply a “directly related cost approach”. The costs that relate directly to a contract to provide goods or services include both incremental costs and an allocation of costs directly related to contract activities. General and administrative costs do not relate directly to a contract and are excluded unless they are explicitly chargeable to the counterparty under the contract.

The Entity will apply these amendments to contracts for which it has not yet fulfilled all its obligations at the beginning of the annual reporting period in which it first applies the amendments.

- Amendments to PFRS 3, Reference to the Conceptual Framework

The amendments are intended to replace a reference to the Framework for the Preparation and Presentation of Financial Statements, issued in 1989, with a reference to the Conceptual Framework for Financial Reporting issued in March 2018 without significantly changing its requirements. The amendments added an exception to the recognition principle of PFRS 3, Business Combinations to avoid the issue of potential ‘day 2’ gains or losses arising for liabilities and contingent liabilities that would be within the scope of PAS 37, Provisions, Contingent Liabilities and Contingent Assets or Philippine-IFRIC 21, Levies, if incurred separately.

At the same time, the amendments add a new paragraph to PFRS 3 to clarify that contingent assets do not qualify for recognition at the acquisition date.

- PFRS 17, Insurance Contracts

PFRS 17 is a comprehensive new accounting standard for insurance contracts covering recognition and measurement, presentation and disclosure. Once effective, PFRS 17 will replace PFRS 4, Insurance Contracts. This new standard on insurance contracts applies to all types of insurance contracts (i.e., life, non-life, direct insurance and re-insurance), regardless of the type of entities that issue them, as well as to certain guarantees and financial instruments with discretionary participation features. A few scope exceptions will apply.

The overall objective of PFRS 17 is to provide an accounting model for insurance contracts that is more useful and consistent for insurers. In contrast to the requirements in PFRS 4, which are largely based on grandfathering previous local accounting policies, PFRS 17 provides a comprehensive model for insurance contracts, covering all relevant accounting aspects. The core of PFRS 17 is the general model, supplemented by:

- A specific adaptation for contracts with direct participation features (the variable fee approach)

- A simplified approach (the premium allocation approach) mainly for short-duration contracts.

- Amendments to PAS 1, Classification of Liabilities as Current or Non-current

The amendments clarify paragraphs 69 to 76 of PAS 1, Presentation of Financial Statements, to specify the requirements for classifying liabilities as current or non-current. The amendments clarify:

- What is meant by a right to defer settlement

- That a right to defer must exist at the end of the reporting period

- That classification is unaffected by the likelihood that an entity will exercise its deferral right

- That only if an embedded derivative in a convertible liability is itself an equity instrument would the terms of a liability not impact its classification

- Amendments to PAS 1 and PFRS Practice Statement 2, Disclosure of Accounting Policies

The amendments change the requirements in PAS 1 with regard to disclosure of accounting policies. The amendments replace all instances of the term ‘significant accounting policies’ with ‘material accounting policy information’. Accounting policy information is material if, when considered together with other information included in an entity’s financial statements, it can reasonably be expected to influence decisions that the primary users of general-purpose financial statements make on the basis of those financial statements.

The supporting paragraphs in PAS 1 are also amended to clarify that accounting policy information that relates to immaterial transactions, other events or conditions is immaterial and need not be disclosed. Accounting policy information may be material because of the nature of the related transactions, other events or conditions, even if the amounts are immaterial. However, not all accounting policy information relating to material transactions, other events or conditions is itself material.

The amendments to PFRS Practice Statement 2 do not contain an effective date or transition requirements.

- Amendments to PAS 8, Definition of Accounting Estimates

The amendments replace the definition of a change in accounting estimates with a definition of accounting estimates. Under the new definition, accounting estimates are “monetary amounts in financial statements that are subject to measurement uncertainty.”

The definition of a change in accounting estimates was deleted. However, the Board retained the concept of changes in accounting estimates in the Standard with the following clarifications:

- A change in accounting estimate that results from new information or new developments is not the correction of an error

- The effects of a change in an input or a measurement technique used to develop an accounting estimate are changes in accounting estimates if they do not result from the correction of prior period errors

- Amendments to PAS 12, Deferred Tax related to Assets and Liabilities arising from a Single Transaction

The amendments introduce a further exception from the initial recognition exemption. Under the amendments, an entity does not apply the initial recognition exemption for transactions that give rise to equal taxable and deductible temporary differences.

Depending on the applicable tax law, equal taxable and deductible temporary differences may arise on initial recognition of an asset and liability in a transaction that is not a business combination and affects neither accounting nor taxable profit. For example, this may arise upon recognition of a lease liability and the corresponding right-of-use asset applying PFRS 16 at the commencement date of a lease.

Following the amendments to PAS 12, an entity is required to recognize the related deferred tax asset and liability, with the recognition of any deferred tax asset being subject to the recoverability criteria in PAS 12.

The amendments apply to transactions that occur on or after the beginning of the earliest comparative period presented. In addition, at the beginning of the earliest comparative period an entity recognizes:

- A deferred tax asset (to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised) and a deferred tax liability for all deductible and taxable temporary differences associated with:

- Right-of-use assets and lease liabilities

- Decommissioning, restoration and similar liabilities and the corresponding amounts recognized as part of the cost of the related asset

- The cumulative effect of initially applying the amendments as an adjustment to the opening balance of retained earnings (or other component of equity, as appropriate) at that date

The Companies are expected to comply with the above PFRS/PAS pronouncements, otherwise, they will be subjected to fines and penalties by the SEC during the monitoring.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

No Comments yet!