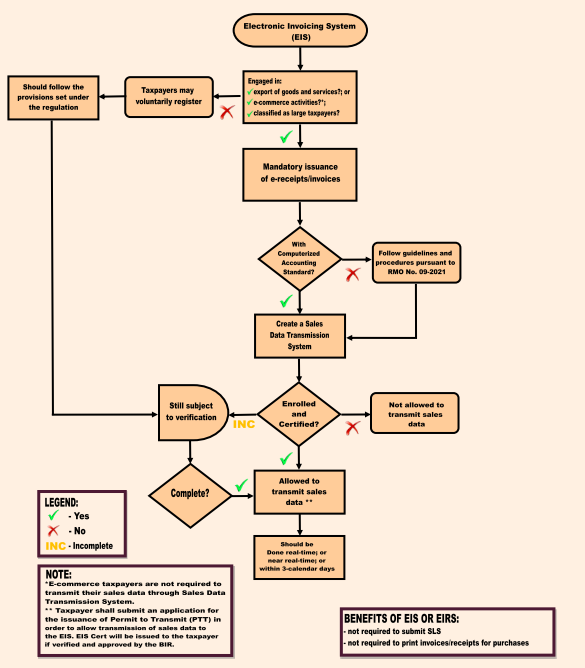

When is EIS/EIRS applicable?

Non-compliance by large taxpayers, e-commerce and export oriented businesses may result to penalties, input VAT or expense disallowance as per RR. Nos. 08-2022 & 09-2022

Frequently Asked Questions (FAQs):

1. What is a Electronic Invoicing System (EIS)?

Answer: EIS is capable of storing and processing data required to be transmitted by covered taxpayers using their Sales Data Transmission System. It’s also capable of issuing sales documents through its web-based issuance facility to be used by qualified taxpayers that will be determined by the BIR.

2. Who are required to issue e-receipts/invoices and transmit sales data through Sales Data Transmission System?

Answer: Taxpayers engaged in export of goods and services, electronic commerce (e-commerce) and those classified as Large Taxpayers are mandated to issue e-receipts/invoices. While only those taxpayers engaged in export of goods and services and those classified as large taxpayers are required to submit sales data through Sales Data Transmission System.

3. What are the policies and guidelines that the covered taxpayers are required to comply?

Answer: Taxpayers are mandated to comply with the ff.:

- Issue e-receipts/e-invoice, transmit data electronically, and create a Sales Data Transmission System based on the Standard Application Programming Interface (API) guidelines which should be certified by BIR through EIS;

- Enrolment of taxpayers prior to the actual transmission of sales data to EIS;

- Submit an application for the “EIS Certification” or “EIS Cert” subject to online verification if compliant with the BIR requirements and application for issuance of Permit to Transmit (PTT) to allow transmission of sales data, regardless of agreement with the software provider. On the day following the issuance of PTT, sales reporting shall be done immediately;

- Transmission of sales data shall be:

- Done real-time or near real-time or within three (3) calendar days from the date of the transaction; and

- In JavaScript Object Notation (JSON) format.

4. Will there be a penalty for failure to submit sales data to EIS?

Answer: Yes, a penalty is imposed for the delayed/late or no transmission of sales data under RR No. 08-2022 Section 4 (10).

5. Are the covered taxpayers still required to submit printed copies of receipts/invoices issued for their sales?

Answer: No, taxpayers duly authorized to use EIS whether through the web-based format or Application Programming Interface (API) transmission sales data, shall not be required to submit printed copies of receipts/invoices under RR. No. 09-2022 Section 2(2).

6. How will it be possible to claim input VAT or deductible expense?

Answer: Only purchases data that are validated in the EIS are allowed for purposes of claiming input VAT and deductible expenses. Purchases that the supplier does not report in the EIS will be considered unreported sales and will be investigated further under RR No. 09-2022 Section 2 (3).

7. What will happen if the taxpayer refuse to allow the Revenue Officer to access Computerized Accounting System (CAS)?

Answer: May result to disallowance or assessments. In addition, violation of the provision may result in the prosecution of the taxpayer under RR No. 09-2009 and will be held liable for the penalties provided under Sec. 255 of the NIRC in addition to any other penalties which may also result in the revocation of the Acknowledgement Certificate or Permit to use CAS.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

Contact our office for any inquiry. (ask@mlaguirre.org)

You may avail subscription on SATORI to know more and get the advice that you need. (iLEAD Academy – T.A.X Satori Tutorial (i-leadacademy.org)

No Comments yet!