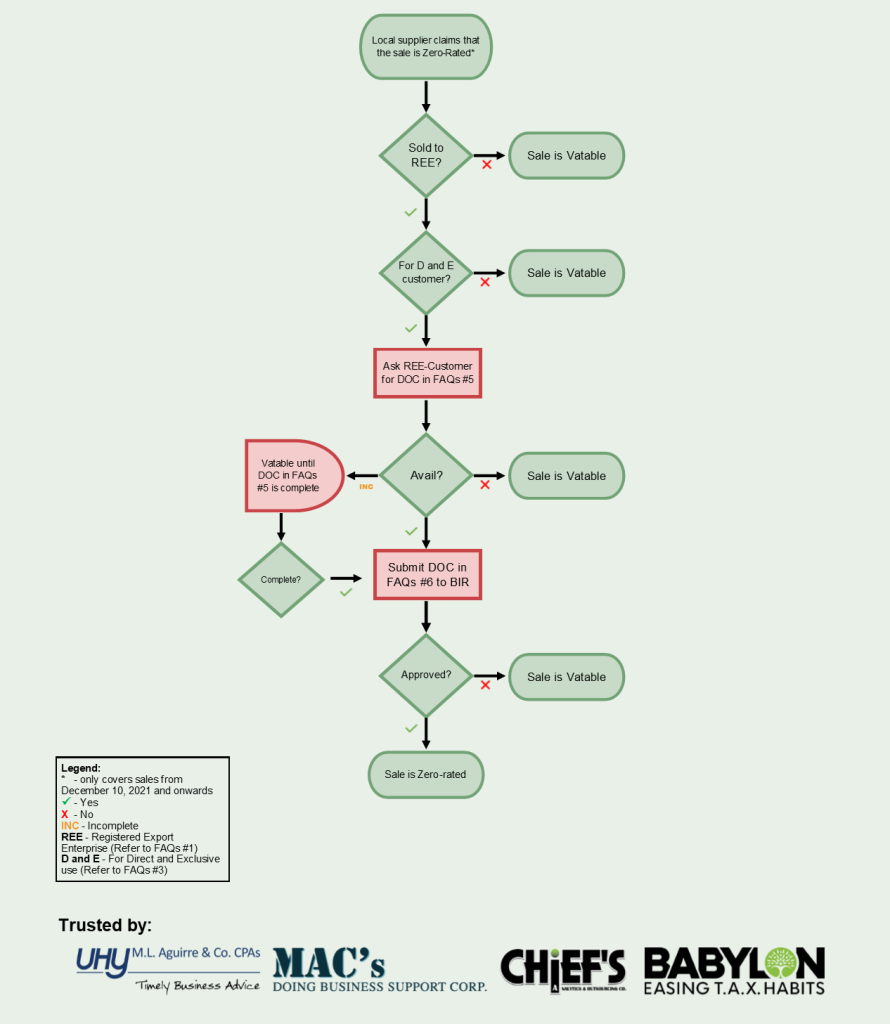

Local Supplier’s VAT Zero-Rated Sales as per BIR RR No. 21-2021 and RMC 24-2022

Frequently Asked Questions (FAQs):

1. What is a Registered Export Enterprise (REE)?

Answer: Any entity existing under Philippines laws and registered with an IPA to engage in manufacturing, assembling, processing, and services such as information technology activities, assembling or processing activities and business process and outsourcing (BPO) and resulting in a direct exportation or sale of its products or services to another registered export enterprise that will form part of the final export product or service of the latter.

2. What is an IPA or Investment Promotion Agencies?

Answer: “Investment promotion agencies (IPAs)” refer to government entities created by law, executive order, decree or other issuance, in charge of promoting, investments, granting and administering tax and non-tax incentives, and overseeing the operations of the different economic zones and freeports in accordance with their respective special laws. These include the Board of Investments (BOI), Regional Bangsamoro Board of Investments – Bangsamoro Autonomous Region in Muslim Mindanao (RBOI-BARMM), Philippine Economic Zone Authority (PEZA), Bases Conversion and Development Authority (BCDA), Subic Bay Metropolitan Authority (SBMA), Clark Development Corporation (CDC), John Hay Management Corporation (JHMC), Poro Point Management Corporation (PPMC), Cagayan Economic Zone Authority (CEZA), Zamboanga City Special Economic Zone Authority (ZCSEZA), Phividec Industrial Authority (PIA), Aurora Pacific Economic Zone and Freeport Authority (APECO), Authority of the Freeport Area of Bataan (AFAB), Tourism Infrastructure and Enterprise Zone Authority (TIEZA), and all other similar existing authorities or that may be created by law unless otherwise specifically exempted from the coverage of the Code.

3. What is Direct and Exclusive use?

Answer: This refers to costs that are indispensable to the project or activity of an REE, without which the project or activity cannot proceed and these includes expenses that are necessary or required to be incurred depending on the nature of the registered project or activity of the export enterprise. Ex., Raw materials purchased are directly and exclusively used in the manufacturing activities of an REE-manufacturing entity or telecommunication expense of an REE-BPO entity.

For this purpose, services for administrative purposes such as legal, accounting and other similar activities are not considered as for directly and exclusively used in the registered activity of any export enterprise.

4. What to do with VAT zero-rated Invoice / Official receipt issued to non-REEs from December 10, 2021 and onwards?

Answer: The originally issued VAT zero-rated invoice / official receipt should be retrieved for cancellation and replacement.

5. What documents should the REE-Customer provide to the Local Supplier-Seller?

Answer: The following should be presented by the REE-Customer prior to the financial transaction;

- BIR – Certificate of Registration (BIR 2303):

- Certificate of Registration issued by the REE-Customer’s IPA:

- VAT Certification issued by the REE-Customer’s IPA: and

- Sworn Declaration stating that the goods/services being purchased shall be used directly and exclusively in the registered activity of the REE-Customer.

6. What documents should the Local Supplier-Seller submit to the BIR?

Answer: Local supplier shall procure a VAT zero-rating certificate from the BIR using the documents provided by the REE-Customers. They need to submit the following requirements to secure the VAT zero-rating certificate:

- BIR – Certificate of Registration (BIR 2303) of the REE-Customer;

- Certificate of Registration issued by the REE-Customer’s IPA;

- VAT Certification issued by the REE-Customer’s IPA;

- Sworn Declaration stating that the goods/services bought by the REE-Customer shall be used directly and exclusively in the registered activity of the REE-Customer; and

- Other documents to corroborate entitlement to VAT Zero-Rating such as but not limited to certified copies of purchase orders, job order or service agreement, sales invoices and/or official receipts, delivery receipts or similar documents to prove existence and legitimacy of transaction.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

Blog Category

Related Post

- Navigating New Horizons – Doing Business in The Philippines Guide 2025

- i-Lead Academy Manual for Members/Students

- Foreign Currency Transactions Treatment for Financial Reporting and Tax Reporting Purposes

- 2023 YEAR END and 2024 1st QUARTER Reportorial Requirements

- Charting the New Frontier: How the 43rd ASEAN Summit Paves the Way for an Unprecedented Era of Trade and Innovation in Southeast Asia.