Clarifications to Revenue Regulation (RR) No. 21-2021

VAT treatment of transactions by Registered Business Enterprises (RBE)

from June 2021 onwards under CREATE

Revenue Memorandum Circular (RMC) No. 24-2022 addresses concerns raised by Revenue Regulation (RR) No. 21-2021 which took effect on December 10, 2021, specifically the VAT treatment of transactions by Registered Business Enterprises (RBE) particularly on the Registered Export Enterprises (REE) where the cross-border doctrine previously applies.

I. Applicability of Cross-border Doctrine

For VAT purposes, the cross-border doctrine was ruled ineffective in RMC No. 24-2022 for enterprises located within freeports and ecozones. Mere registration as an RBE does not automatically entitle its local purchases of goods and services for VAT zero-rating. As a result, RBEs, particularly the export oriented enterprises should identify their purchases from local suppliers or establish whether the transaction is used directly and exclusively in the registered project or activity. This does not include purchases made for administrative purposes.[1] For expenses that are used for both the registered activity and administrative purposes, the best allocation method shall be applied. If proper allocation cannot be determined, the entire purchases shall be subject to 12% VAT.

II. Direct and Exclusive

As defined in RR No. 21-2021, direct and exclusive use in the registered project or activity refers to raw materials, supplies, equipment, goods. packaging materials, services, including the provision of basic infrastructure, utilities, and maintenance, repair and overhaul of equipment, and other expenditures directly attributable to the registered project or activity without which the registered project or activity cannot be carried out.

Direct cost under RR 11-05 for purposes of computing the Gross Income Tax (GIT) or Special Corporate Income Tax (SCIT) is not entirely equivalent to the directly and exclusively rule for VAT-zero rating purposes. As an example, welfare cost or insurance premiums of factory workers cannot be claimed for VAT zero-rating since it is a dispensable cost to the registered activity but may be claimed as a direct cost for GIT/SCIT computation purposes.

III. VAT Treatment of Sales to Registered Business Enterprises (RBE)

Based on the RMC, the classification of RBE whether a Domestic Market Enterprise (DME) or a registered export enterprise (with maximum 17 years of VAT zero-rating reckoned per Certificate of Registration, unless extended by SIPP) shall be considered to know the proper treatment of VAT for transactions entered by RBEs.

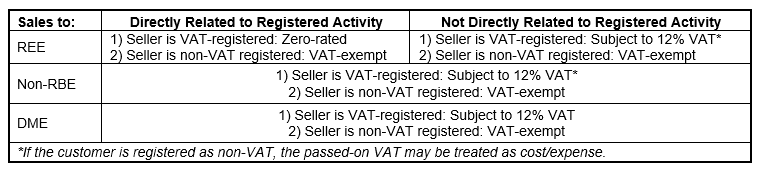

To illustrate, we have summarized the rules set forth under the RMC:

The same rules shall apply for the sell, transfer, or disposal of previously VAT-exempt imported capital equipment, raw materials, spare parts and accessories. However, if the said imported capital equipment, raw materials, spare parts and accessories were utilized for the non-registered project or activity, the corresponding VAT on importation shall apply and be paid accordingly.

In order to avail the said VAT zero-rating, the registered export enterprise shall submit the following to their local suppliers prior to transaction with them:

- Photocopy of BIR – Certificate of Registration

- Certificate of Registration

- VAT Certification issued by the concerned IPA

- Sworn Declaration – stating that the goods/services being purchased shall be used directly and exclusively in the registered project

The same documents above shall be submitted by the local suppliers to the BIR for compliance with the requirement of “prior approval” of goods/services of registered export enterprise in order to avail the VAT-zero rating on goods and services directly related and exclusively used in their registered activity or project. Absence of prior approval may result in the imposition of VAT to previously VAT-zero rate sale of local supplier.

In addition to the other documents to corroborate entitlement to VAT zero-rating, the supplier may submit supporting documents such as but not limited to duly certified copies of purchase order, job order or service agreement, sales invoices and/or official receipts, delivery receipts, or similar documents to prove existence and legitimacy of the transaction. Guidelines and procedures under RMO No. 7-2006 will still apply for VAT zero-rating applications.

Furthermore, the Tax Code still applies to sales to non-RBE export-oriented enterprises and enterprises covered by special laws, which cannot claim zero-rating for the local purchases of goods/services.

IV. VAT Registration Status of Registered Export Enterprises

RMC No. 24-2022 also states that registered export enterprises that already lose its entitlement to ITH[2] and will avail the tax incentive under the 5% GIT or SCIT are mandated to dispose their VAT registration status to non-VAT. For this purpose, those that are currently under 5% GIT or SCIT as of the effectivity of CREATE shall have two (2) months from effectivity of the RMC (or until May 9, 2022) to change its registration to non-VAT.

V. Transitory Provisions

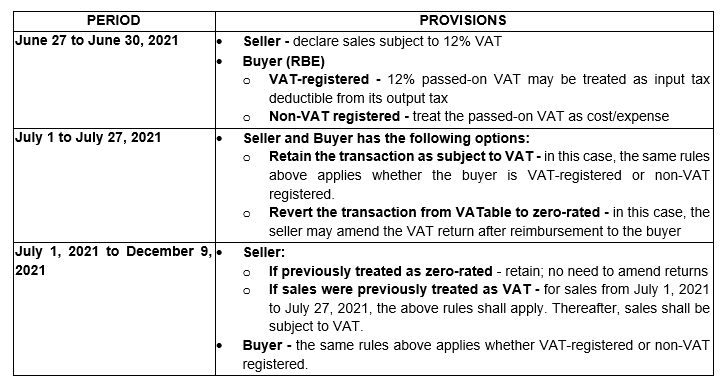

The BIR has issued three revenue regulations in the year 2021 to introduce the CREATE Implementing Rules and Regulations. Particularly, the issuances are as follows:

- RR 9-2021 – took effect on June 27, 2021 which imposed 12% VAT on indirect exports and sales of goods and services;

- RR 15-2021 – took effect on July 27, 2021 which defers implementation of RR 9-2021; and

- RR 21-2021 – effective on December 10, 2021 but provides for retroactive application starting July 1, 2021.

The retroactive application shall only apply to transactions that may benefit the taxpayer such as reverting the previously taxed transaction to a zero-rated transaction. Below is the summary of the provisions of the application of the above regulations:

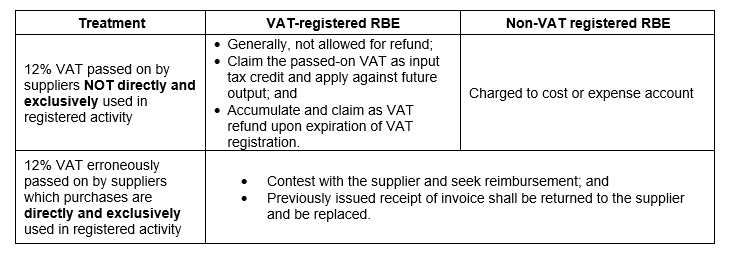

VI. Treatment of inadvertently paid or passed on VAT

For everyone’s guidance and perusal.

Enclosed is the copy of RMC No. 24-2022 for your reading pleasure.

RMC No. 24-2022.pdf (bir.gov.ph)

[1] Such as legal, accounting, and such other similar services, are not considered expenses directly attributable and exclusively in the registered project or activity.

[2] If the RBE has multiple registered activity, it shall report as VAT-exempt all of its sales from registered activities while the sales under ITH shall be reported as zero-rated.

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely a general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncement, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

Blog Category

Related Post

- Navigating New Horizons – Doing Business in The Philippines Guide 2025

- i-Lead Academy Manual for Members/Students

- Foreign Currency Transactions Treatment for Financial Reporting and Tax Reporting Purposes

- 2023 YEAR END and 2024 1st QUARTER Reportorial Requirements

- Charting the New Frontier: How the 43rd ASEAN Summit Paves the Way for an Unprecedented Era of Trade and Innovation in Southeast Asia.