Republic Act 11904 or ‘The Philippine Creative Industries Development Act’

Republic Act (R.A.) 11904 or ‘The Philippine Creative Industries Development Act,’ which was passed into law on July 27, 2022, mandates the promotion and development of Philippine creative industries by protecting and strengthening the rights and capacities of creative firms, artists, artisans, creators, workers, indigenous cultural communities, content providers, and stakeholders in the creative industries. The Philippine Creative Industries Development Council was created to oversee efforts to develop, improve, and promote the country’s creative industry sector.

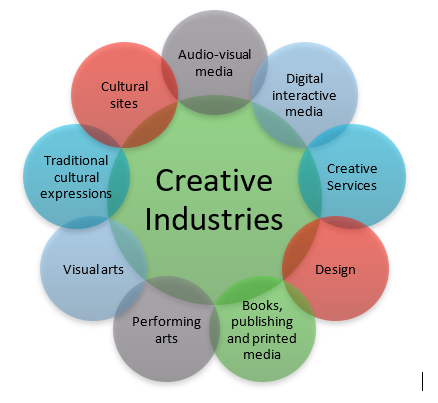

R.A. 11904 defines the creative industries as “trades involving persons, whether natural or juridical, that produce cultural, artistic, and innovative goods and services originating in human creativity, skill, and talent, and having a potential to create wealth and livelihood through the generation and utilization of intellectual property.”

It called for the creation of the Philippine Creative Industries Development Plan by the Council headed by the Secretary of the Department of Trade and Industry, with other nine (9) ex officio members, and nine (9) regular members from the private sector to oversee the creative industry domains namely:

a. Audiovisual media.

b. Digital interactive media.

c. Creative services.

d. Design.

e. Publishing and printed media.

f. Performing arts.

g. Visual arts.

h. Traditional cultural expressions; and

i. Cultural sites.

CSE I SENIOR ASSOCIATE II

DISCLAIMER: The advisory is not a substitute for an expert opinion and is purely general research that may have not considered the entirety of other related topics. Any tax and/or compliance advice is not intended or written by the author to be used, and cannot be used, by a client or any other person or entity for the purpose of (i) avoiding penalties that may be imposed on by the regulatory bodies, or (ii) promoting, marketing, or recommending to another party any matters addressed herein.

The opinion or advice expressed in this advisory is based on the facts and circumstances gathered. Any inaccuracy in any of the assumptions set forth above may have the effect of changing all or part of this report, and this report may not apply. The advice is based on our interpretation of the provisions of the Code, the Revenue Regulations promulgated and issued by the tax bureau, BIR positions as set forth in published Revenue Rulings, other pronouncements, orders and circulars, and judicial decisions in effect on the date of this report, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions/ advice expressed herein In effect, this might render the advisory obsolete or incorrect in partial or in full. We undertake no obligation to advise you of changes that may hereafter be brought to our attention.

LET US HELP YOU ACHIEVE FURTHER BUSINESS SUCCESS

Visit us online at www.mlaguirreco.com to find out more about our services, or email us at ask@mlaguirre.org for further information or any queries.

UHY M.L. AGUIRRE AND CO., CPAs

Unit 1807 Cityland Pasong Tamo Tower

2210 Chino Roces Ave., Makati City, 1230 Philippines

Phone: +63 2 8812 2568

Mobile: +63 9228347966

Email: ask@mlaguirre.org

UHY M.L. Aguirre & Co., CPAs (the “Firm”) is a member of Urbach Hacker Young International Limited, a UK company, and forms part of the international UHY network of legally independent accounting and consulting firms. UHY is the brand name for the UHY international network. The services described herein are provided by the Firm and not by UHY or any other member firm of UHY. Neither UHY nor any member of UHY has any liability for services provided by other members.”

© 2022UHY M.L. Aguirre & Co., CPAs

No Comments yet!